A key consideration when purchasing a home is whether you’re going to build a new property or buy an existing one.

There are a range of advantages and drawbacks of each option, highlighting the importance of weighing it up based on your personal circumstances. Making the decision comes down to researching and understanding each option, seeking advice from experts to make informed decisions and, most importantly, trusting your gut about what is best for you.

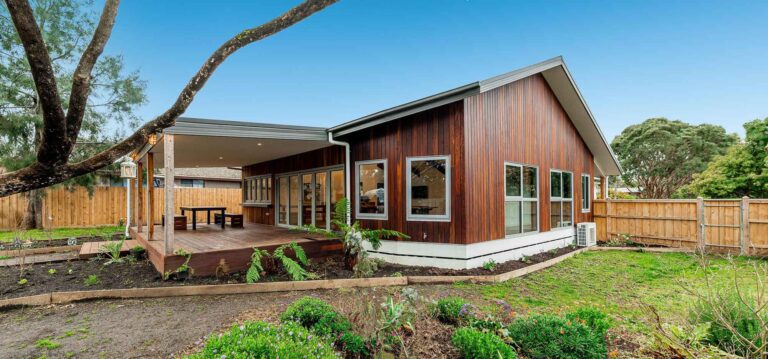

Building Your Own Home

Building your own home is a great way to acquire the dream property you’ve always wanted, but there are a few potential drawbacks that should be carefully considered.

Advantages of Building

Greater Control & Customisation

One of the primary advantages of building your own home is you are able to create your dream home, within the constraints of regulations and your budget.

When building, you can create the floor plan you desire, select specific fixtures and prioritise where your money is spent. For example, you may choose to have an extra bathroom over a bedroom, or you could choose simple light fittings to spend more money on your dream kitchen.

Stamp Duty Savings

Generally, when you buy a house, you are required to pay stamp duty based on the value of the block, as well as the house built upon it. However, if you buy land to build your own home, you will only pay stamp duty based on the value of the land. This means you won’t have to pay stamp duty on the house you build, which can work out to be a substantial saving.

Lower Ongoing Maintenance & Increased Energy Efficiency

Depending on your contract, new properties generally come with a builder’s guarantee. How your guarantee works, the length it lasts and what is covered by it, may be different depending on the state in which you’re located.

New properties are generally built to a high energy efficiency standard through the use of newer appliances and building practices. This can contribute to lower overall running costs of your new home.

Drawbacks of Building

Length of Process

There’s no two ways about it – building your own home is a lengthy process. You may have to wait months or even years for your new home to be built, but building also requires greater involvement from you over the process. There are a range of decisions you need to make over the course of your home’s construction project which can be a significant time cost on your part.

Unexpected Costs

Making changes or adding extras throughout the build process can quickly see your costs exceed your budget. Even if you stick to the original plan, there may be unexpected costs throughout your project. For example, your block may have a slope or poor soil quality, both resulting in extra costs. It is a good idea to set aside a contingency budget or work in a buffer just in case of delays or unexpected issues.

Unpredicted Delays

There is always the possibility of unpredicted delays when building a new home. These disruptions can be caused by a range of things including weather conditions, supply chain delays, labour shortages and site conditions to name a few. Proactive planning, effective communication and a comprehensive contingency plan are essential in mitigating the various challenges you may face throughout a new home build.

Buying An Established Home

Much like building from scratch, purchasing an established home offers both advantages and disadvantages that should be carefully considered.

Advantages of Buying

Quick Turnaround

Generally, it is faster to buy and move into an established house than it is to build a new home. The period between signing the contract on a house and moving in can be as little as 30 days, depending on the settlement period you choose. In theory, this means you could view a property you like, decide to buy it and have the keys within the space of a month or two.

What You See Is What You Get

When purchasing an existing home, you will generally be able to inspect the property yourself to get a feel for it. During this inspection, you’ll be able to examine the condition of the house, gaining an understanding of potential structural issues or pressing maintenance matters. With a building and pest report, you’ll also find out if there are any current or former infestations at the property.

When purchasing a home, it is a possibility to make the sale conditional, based on the result of the building and pest inspection. If any major issues are uncovered, you’ll be able to back out of the purchase.

Established Suburbs & Facilities

Another advantage of purchasing an existing home is the fact more often than not, these properties are located in established suburbs, within close proximity to amenities such as schools, public transport and retail outlets.

Vacant land, or house and land packages, are often located in newer estates and neighbourhoods, meaning you may have to wait a few years for facilities and infrastructure to be built around you.

Drawbacks of Buying

Need For Renovations

A drawback of purchasing an existing home is the fact it may require renovations, and in turn additional costs. Some old homes will require plumbing and electrical inspections to ensure everything is safe and working effectively, before a contract is signed. If these inspections are neglected, it could end up costing thousands of dollars in repairs down the line.

Government Fee Potential

When buying a house, you will have to pay stamp duty on the property. Also known as transfer duty, this expense is a tax charged by Australian state governments for the purchase of a property – and it can add a significant sum of money to the overall cost of your home. Buying an empty block to build on can significantly reduce the stamp duty you are required to pay.

Outdated Appliances

A lot of older houses can have fixtures and appliances which are outdated, often consuming more energy than modern alternatives and driving energy expenses up. These can range from old systems which need maintenance or replacing such as hot water and air conditioning, or could relate to features or layouts that need modernising.

Other Considerations

There are also some external factors and trends to keep an eye on which can guide your decision making around building or buying.

Market Conditions

The real estate market can be imagined as a big see-saw – sometimes it tilts towards a seller’s market where homes are in high demand, but supply is low. This can cause prices to soar and competition for existing homes becomes fierce. Alternatively, when the market tilts towards a buyer’s market, where plenty of properties are available, you may find a great deal on an existing home that you can’t pass up.

Interest Rates

Interest rates can significantly impact a decision to build or buy a home. Lower rates reduce the costs of borrowing, making mortgages cheaper and increasing overall affordability. This stimulates demand for both new and existing homes. High interest rates increase the expense of borrowing money, which can impact on demand. Fluctuations in interest rates directly influence the attractiveness of building versus buying in the current market, in turn shaping decisions regarding home ownership.

Why Choose Yarrington?

At Yarrington Construction, we transcend the role of mere builders, turning dream homes into breathtaking realities. With over two decades of experience in construction, we epitomise excellence, approaching each project with unparalleled design and craftsmanship. With a focus on quality, each development we undertake offers timeless elegance for both residential and commercial clients. Driven by a passion for innovation and meticulous attention to detail, we aspire to leave a lasting legacy through distinctive design and superior construction. For those seeking leading quality and service, Yarrington Construction is your go-to builder in the Bendigo region. Reach out to our friendly service team to discuss your next project today!